Lake Lanier Homeowners Face Reassessment - Norton's White Paper

Many property owners in Hall County who own Lake Lanier fronting property are incensed about a recent reassessment of property values. This reassessment of 6,558 lakefront homes has sparked a campaign amongst many local residents, as reported in Gainesville Times on June 19, 2014. In this article, it is reported that 90 percent of lakefront properties will see a tax increase.

Some homeowners I have spoken with have assessments that have doubled or even tripled in value. As to the comments regarding boat docks, I take issue with the fact that Hall County's Chief Tax Assessor thinks boat docks are real property. In an email to The Times, Watson wrote:

"Boat docks have always been valued as a part of the real property. That is something that has not changed. There is not a precedent necessarily other than that we have been taxing them for as long as I can remember."

Darla Eden, Tax Commission of Hall County offered this explanation as to why docks are classified as real property in an email to The Times:

“The (Georgia) tax commissioner’s manual defines real property as land and generally anything that is erected, growing or affixed to the land. Tangible personal property is defined as property, other than real, that may be weighed, measured or touched. Essentially, personal property is anything that can be owned that is not real estate. With those definitions, there could be a strong argument to classify docks as real or personal depending on how you define ‘affixed to the land.’”

When I sell a lakefront property, a Personal Property Agreement (Bill of Sale) is a part of the contract because the dock is personal property. It is not part of the real estate.

Frank Norton, Jr., CEO/Chairman at The Norton Agency and renowned researcher/economist has just authored a white paper regarding this issue of reassessment. The white paper follows in its entirety:

HALL COUNTY LAKE

PROPERTY TAXES WHITE PAPER – MAY, 2014

BACKGROUND

In an effort

to raise county revenue and provide “equalization” to all Hall County’s tax

base, the county commission upon recommendation of Steve Watson, Chief

Appraiser, employed a third party

consultant Georgia Mass Appraisal Solution & Services (GMASS) to re-evaluate the values of 6,558 Hall County

Lake Front properties by the 2014/2015 tax year. While many believe that the

county is simply going after “low hanging fruit” for the tax revenue, there was

antidotal evidence that isolated properties fronting on Lake Lanier had been

over looked for reassessment for as much as 20 years (mostly lake lots and 1995

pre-existing homes).

Because of the perception that only “rich”

folks live on Lake Lanier, this initiative might be characterized as a “luxury

tax." With only 6,558 parcels out of a

county total of 75,000 being reevaluated, calls of “fairness” equality and

excessive values by lake property owners affected will simply be heard as cries

in the wilderness and fall on deaf ears.

MARKET CONDITIONS

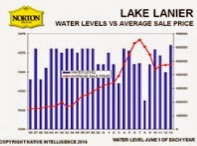

Today, the

Hall County lake property hangs in a delicate balance. Since a market peak in

2006, the lake real estate market has been slammed with a triple whammy; historic

low water levels, a national real estate market depression and because of the

drop in consumer confidence, the evaporation of second home buyers which was

once 32% of the market. After the lake level returned to full pool (2012) and

the National Economic storm settled down, we have seen improvements in Lake

Lanier real estate but only in measured steps.

Assessed value is not the same as

real market value.

MARKET COMPARISON

Hall

County December

2006 December 2013

Average Lake

Home Price $645,000 $475,000

Months of

Supply Overall 15 Mo 14.5 Mo

Months of

Supply Hall Co 12.8 Mo 14.6

Mo

Months of

Supply over $1 Million 36 Mo 64.8

Mo

# Homes Sold

Over $1 Million 13 5

Annual Lake Homes

Sold 124 117

Source: Data based on Norton Native

Intelligence, FMLS, and GA MLS, measuring only lake homes with on property boat docks.

LUXURY HOMES

It seems from our initial review that luxury homes, those over $850,000 in

tax value have been hit the hardest with the new tax reassessments.

Statistically that is the softest market on Lake Lanier (in its entirety) and

specifically in Hall County which has 26 homes over 1 Million Dollars (in

asking price) or a 64.8 month of supply.

Only 5 Hall County homes over One Million Dollars traded hands in 2013

according to First Multiple Listing Source/Georgia MLS.

Our analysis only includes properties with onsite boat docks. An

additional five homes over One Million are for sale in Harbour Point which have

group or shared boat docks making that a total of 31 Million Dollar lake homes

currently for sale in this county.

Norton Native Intelligence™

would call that an over-saturated market.

MASS ASSESSMENT

GMASS was paid around $50.00 per Hall County Lake Lanier property and in

no way could have accurately ascertained the real value of Lake Lanier real

estate. Norton Professionals and Real Time

Buyers know that lake properties are individual; no two tracts are the same.

Unique characteristics include permitable dock and lake accessability,

quality and size of boat dock, topography / terrain, foliage and tree cover,

view, water depth at full pool and water depth when the lake is down 19 feet. Premiums decided by a computer are not always

a premium. So it is clearly in a lake

owners best interest to seek a second opinion, understand the rationale and

County’s support documentation for the County’s new assessment. Compare. And then consider a challenge to determine a

REAL 2014 value. We believe actual

market comparables (sales closed, not homes listed with potentially speculative

pricing) are the most valuable correlation to comparables property value.

UNINTENDED CONSEQUENCES

The premise that Hall County’s Lake market has

rebounded completely from the depressed levels in unfounded and Norton Native

Intelligence™ warns of major unintended consequences.

Fight: Expect a fight by “mad as hornet” lake

property owners seeking to appeal their May 2014 assessment, this includes

calls for commissioner recall, injunctive relief or class action lawsuits. The use of isolated, property sales may be

punishing the masses.

Flood: Expect a flood of lake property owners

to put their homes or vacant lake lots on the market in light of their taxes

going up 50 – 100 or 200% and the added tax burden for a population base that

is aging. This will place download pressure on Lake Property prices and will increase

the months of supply (inventory) in every category.

Flight: Potential lake buyers are attracted

to water not geographic counties

surrounding the home or lot. Schools and county taxes in Dawson and Forsyth

counties in some cases are cheaper and lake customers will strongly consider those

alternative locations, as well as consider properties outside of municipalities

like the City of Gainesville where there is an added city tax.

Note: NNI believes that if Hall County is successful

in raising the lake tax digest then Forsyth and Dawson County will initiate

Lake Front assessments in short order.

GOING FORWARD

We strongly

disagree with the Hall County Tax Assessors “equalization” initiative and their

contention that it is truly “equal” regardless of isolated lake property

under-assessments. We believe that Hall County should have reassessed all county property and not just single

out lake property owners.

However it is done, so we encourage and support every

lake owners’ right to appeal and engaging in a public hearing/debate on real

values and the reality of today’s resale market. Norton has been successful in

court action against irrational Hall County tax valuations in the past and

while we do not advocate court action, we do advocate speaking up and challenging

Hall County officials to support these new valuations in the wake of the

current Lake Lanier housing market.

APPEAL

The Georgia

legislative has established a clear process for the average taxpaying property

owner to challenge any county valuation. First and foremost, you must remember there

are critical timeframes to set the appeals in motion.

You have 45 days after the date of

your notice to file an appeal (the date is clearly posted at the top of your

2014 tax assessment notice. If you do not file using official appeal forms your

right to file an appeal will be lost.

Appeal forms are at the

tax office, 2875 Browns Bridge Rd, Gainesville, GA 30504 or can be downloaded

at https://etax.dor.ga.gov/ptd/adm/taxguide/appeals.aspx.

At the time

of appeal, you must decide on one of the following:

1- Appeal to the County Board of

Equalization with appeal to the Superior Court. (Value, uniformity, denial of

exemption, taxability).

2- To arbitration without an appeal to

the Superior Court (valuation is the only grounds that may be appealed to

arbitration)

3- For a parcel of non-homestead

property with a FMV in excess of $1 million, to a hearing officer with appeal

to the Superior Court.

OUR ADVICE

§ To facilitate your appeal our advice

is to select #1, fill out and submit the form to appeal and prepare to go to

the County Board of Equalization which is made up of Hall County citizens. After

your hearing and their ruling if you do not like their decision, it could be

appealed to the Superior Court for review.

§ Go to the appeal personally. We believe citizen to citizen interaction is far more

valuable on residential properties. You may wish to have your attorney present

but make the appeal personally. You know your property better than anyone and

can answer any questions that may arise.

§ Arm yourself with information. Employ one of Norton’s expert Lake Agents to prepare a

market evaluation, sales comps and detailed market conditions on your property

and the neighborhood surrounding (see below) or engage an outside third party

appraisal, $500 - $1,200 to prepare an evaluation of your property to assist

you in your equalization presentation. Make copies of the presentation

materials (facts and figures) to hand out to the Board of Equalization at your

hearing.

§ Your presentation should be cool, calm, collected and professional.

Remove the emotion from your presentation and base your statements on facts and

data as much as possible.

§ Be careful what you wish for. The appeal process gives Hall County the right to appraise your

property inside and out and to do a thorough investigation on a proper

valuation. This could cause a review of your finished improvements, re-measure

incorrect finished space/square footage and look at the quality of

construction.

§ Prepare to chip away at their value,

not roll it back to 2013 levels and plan to repeat this process annually so

long as values of lake property remain static.

§ Conversely there are several qualified

third party tax appeal process firms that can be hired for a percent of the tax

savings, but we advocate the personal involvement route.

CONSULTING

Norton’s

Lake Team can prepare a taxpayer assistance report including a market valid

broker price opinion, (BPO) sales comps and market data report. This is not

needed at time of appeal but would be used at time of the equalization hearing.

Rates for our BPO’s are as follows:

Homes $0 – 750,000 value $350.00

$750,000 & Up $450.00

Hourly rate for attending Equalization Hearing $125.00/hr.

(*Norton agrees to credit the above fees against a

sales commission should the property be listed and sold by Norton in the next

36 months.)

This is a complicated but

important process and we stand by our clients and our detailed market research.

The study is powerful and the tax assessors have gotten this wrong.

For more information,

contact your Norton Real Estate Professional.

Frank Norton, Jr.

Chairman/ CEO

The Norton Agency

434 Green Street

Gainesville, GA 30501

Disclaimer: The information herein has been deemed

reliable. Please consult your personal lawyer or CPA for independent advice

concerning personal tax and litigation issues.

Partner/Associate Broker

770.297.4827 Direct

770.540.3788 Cell

Selling North Georgia Since 1988

This is very nice article and very helpful. Lake Lanier Real Estate is very good real estate. They provide many beautiful houses and apartments. You can see Real estate auction websites for see many sweet-able apartment.

ReplyDelete